Google Tez: A Payment App By Google Launched In India

With the increasing number of online buying and selling, transactions on the internet have become inevitable. Also, these transactions are starting to make our lives much easier. With the increasing number of online transactions, the number of online payments app are also increasing faster. One such application is the new Tez app by Google.

A Free Mobile Wallet.

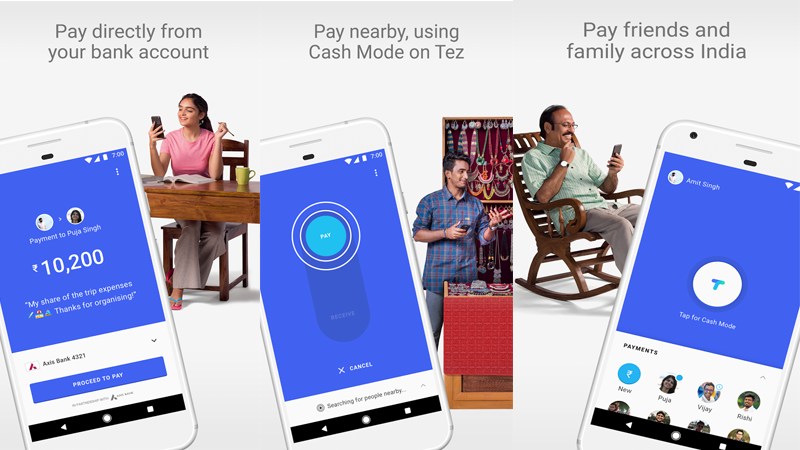

A few days ago, Google officially unveiled its first big foray into mobile payments in Asia. The Android and search giant has launched Tez. It is a free mobile wallet in India. It will let users link up their phones to their bank accounts. This way they can make payments securely in physical stores and online. Person-to-person money transfers comes with a new twist: Audio QR. It uses ultrasonic sounds to let you exchange money, bypassing any need for NFC.

UPI-Based.

Tez has already gone live on Google’s Play Store and Apple’s App Store on iOS. Google’s Tez is based on UPI platform. UPI stands for United Payments Interface. It has been made by the National Payments Corporation of India (NPCI). UPI allows for easy transfer for payments within bank accounts. With UPI, you can make transactions by simply relying on the mobile number of the VPA (Virtual Payment Address). This way you can make a payment straight to the bank account. This is easier, rather than requiring the full bank account number, IFSC code, etc.

NPCI’s UPI.

So now you can send money to friends, instantly receive payments directly to your bank account & pay the nearby café. You can do all this with Tez. Tez is Google’s new digital payment app for India. Money transfers are made simple & secure with Tez. Thanks to NPCI’s (National Payments Corporation of India) Unified Payments Interface (UPI).

Basic Features.

– Money can be transferred directly to your bank account. Simply link your account to Tez over UPI and instantly transfer money from bank to bank.

– Your money will always be safe, you can be ensured. With Google’s multi layered security and 24/7 protection by Tez Shield, you can now make payments and transfer amounts both big and small.

– It is easy to send or receive payments to anyone instantly. This can be done without sharing personal details like your phone number or bank account. Thanks to Tez’s Cash Mode.

Upcoming Features.

– You can make payments through debit and credit cards on Tez.

– You can pay and set reminders for recurring bills such as DTH.

Supports Regional Languages.

Google also plans to launch a version of the app for businesses as well. Though the businesses will have to register to show interest in the same. This will be based on the Tez website. Google’s Tez will sync with the user’s mobile number. The number has to be the same number which is synced with the bank account. The bank account also needs to support the UPI platform. The app supports seven Indian languages. These include Hindi, Tamil, Bengali, Gujarati, Telugu, Kannada, Marathi, and it supports English as well. Users can always go to settings and change the primary language.

Syncs With Your Google Account.

You have to make that your SIM is working, if that number is linked to your bank account. The Tez app also syncs with the Google account as well. You have to first input the mobile number when setting it up. After that, you will have an option of setting a secure lock code for the app via Google Pin. Or you can just use the screen lock pattern/pin/password. You will be required this passcode each time you open the app. This is not the same PIN required to carry out transactions. You will be asked to link the relevant bank account for UPI-based transactions. You will have to keep the debit card handy to set this up. A bank OTP is required for verification along with the UPI Pin, once you are done with entering the details. You will have to create a new UPI Pin, which will be required to carry out transactions.

Launch Offers.

Google also has some launch offers for the Tez app. You can get Rs 51 for inviting your friends. But you get that once the friend makes a payment using the app. The offer is valid till 1 April, 2018. The limit is Rs 9000 per year. There’s also a scratch card option. If you make a payment of Rs 50 or more this week, you stand the chance of winning Rs 1 lakh in a lucky draw each week. Finally for payment for Rs 50 or more, each user gets a scratch card which will earn them up to Rs 1000. The limit here too is Rs 9,000 for the year.

Nisarg is the Business Development Manager at Nimblechapps, a top mobile game development company and has been with the organisation since its inception in 2014. He likes to update his knowledge on changing trends in technology and marketing and pens his thoughts regarding the same on various blogs and LinkedIn.